Unpacking the Past: How Interest Rate Cuts Have Shaped the Economy and What to Expect in 2024

Table of Contents

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Rate Cut 2024 | Inflation Persists | Comparing Narratives

- Us Fed Rate Cuts 2024 - Kara Sandie

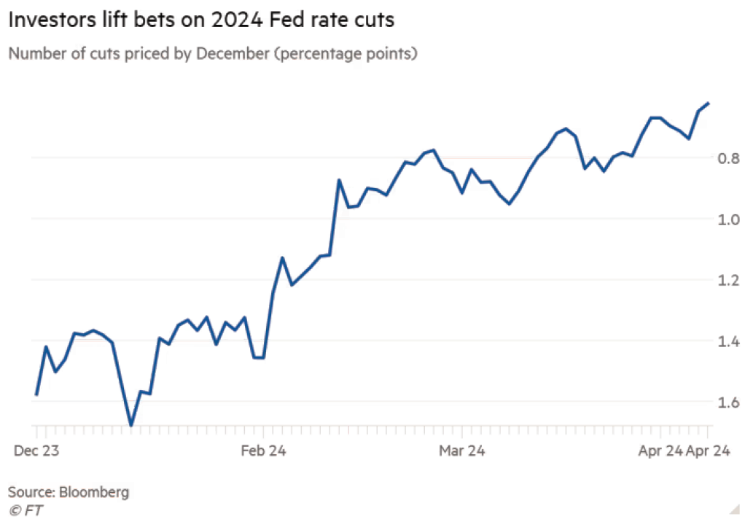

- 4 Charts on Plunging Expectations for Fed Rate Cuts | Morningstar

- Federal Reserve rate cut seen in Q2 of 2024 | Forexlive

- Interest Rate Cuts 2024 Canada - Molly Therese

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Fed Holds Rates Again. Expect Cuts in 2024 - NerdWallet

- Fed Rate Cuts 2024 Dates - Fredia Violet

- US Fed divided on risk of cutting rates too soon: minutes - Briefly.co.za

Past Interest Rate Cut Cycles: A Historical Perspective

Impact on the Economy: A Closer Look

2024 Forecasts: What to Expect

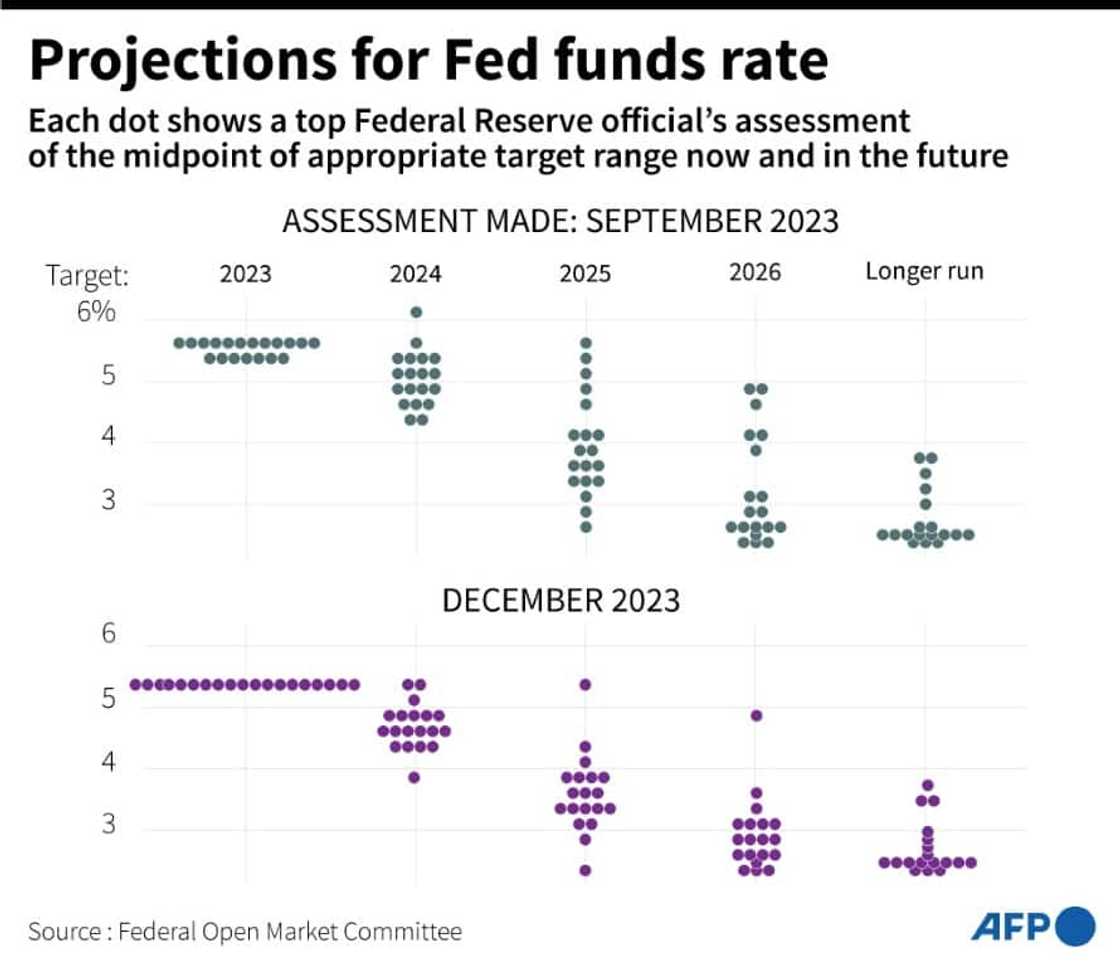

As we look ahead to 2024, economists and analysts are closely watching the Federal Reserve's monetary policy decisions. Some key forecasts include: Interest Rate Hikes: The Fed is expected to raise interest rates to combat inflation and maintain economic stability. Economic Growth: The global economy is projected to experience moderate growth, driven by emerging markets and technological advancements. Market Volatility: Investors should be prepared for increased market volatility, driven by geopolitical tensions, trade uncertainties, and monetary policy shifts. In conclusion, understanding past interest rate cut cycles and their impact on the economy can provide valuable insights into future trends. As we navigate the complexities of the global economy, it's essential to stay informed about monetary policy decisions and their potential effects on various aspects of the economy. By examining historical data and forecasts, investors and economists can make more informed decisions and prepare for the challenges and opportunities that lie ahead in 2024.Stay ahead of the curve and stay informed about the latest economic trends and forecasts. Subscribe to our newsletter for exclusive insights and analysis.