As part of the American Rescue Plan, the Internal Revenue Service (IRS) has been issuing $1,400 stimulus checks to eligible individuals and families. The third round of stimulus payments aims to provide financial relief to those affected by the COVID-19 pandemic. But who qualifies for these checks, and why are they being sent? In this article, we'll delve into the details of the $1,400 IRS stimulus checks, including eligibility criteria and the reasoning behind their distribution.

Eligibility Criteria for $1,400 IRS Stimulus Checks

To qualify for the $1,400 stimulus check, individuals and families must meet specific income and eligibility requirements. The IRS uses the following criteria to determine who is eligible:

Income Limits: Single filers with an adjusted gross income (AGI) of $75,000 or less and joint filers with an AGI of $150,000 or less are eligible for the full $1,400 payment. Those with higher incomes may still receive a reduced payment.

Dependents: Eligible individuals can also claim an additional $1,400 for each dependent, including children and adult dependents.

Citizenship: Only U.S. citizens, U.S. nationals, and resident aliens are eligible for the stimulus payment.

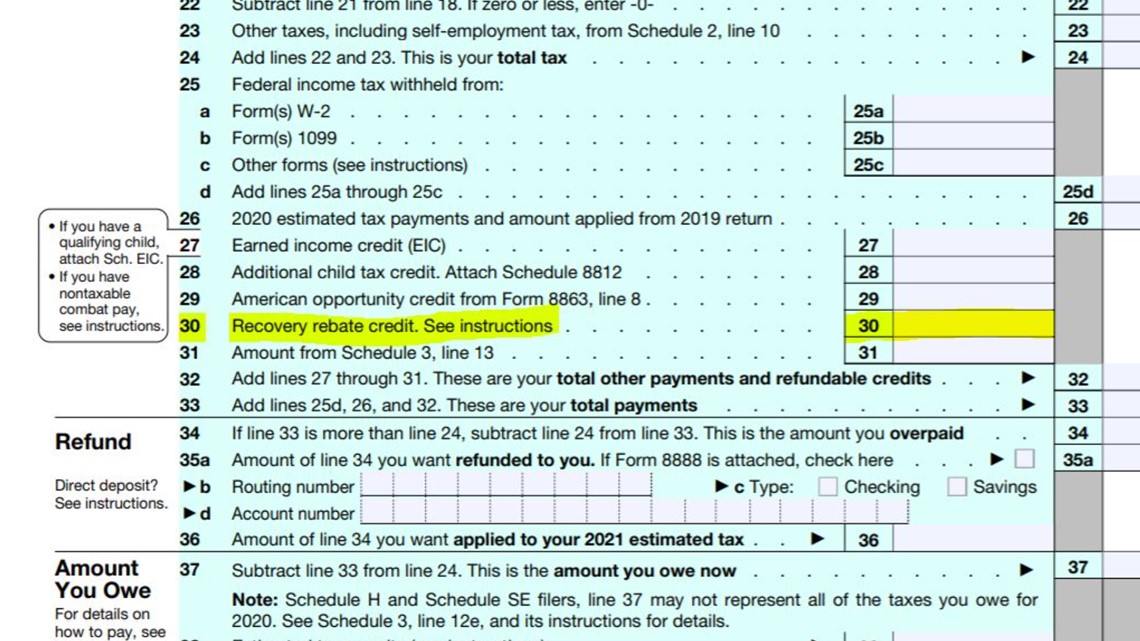

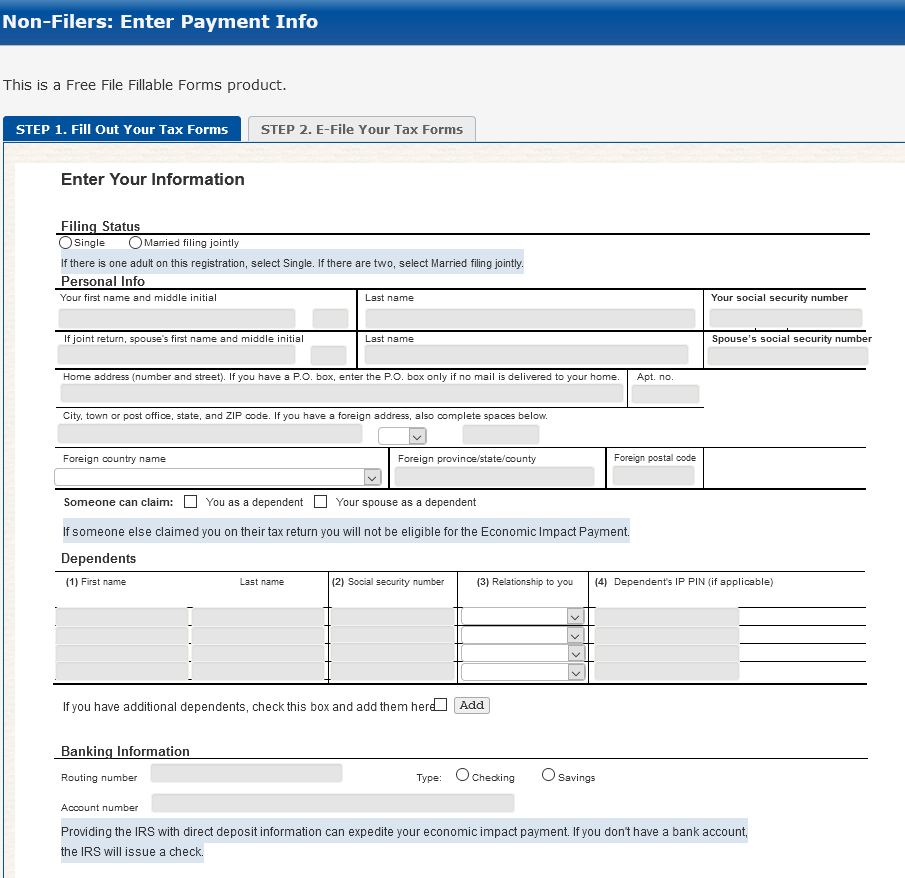

Tax Filing Status: Individuals who filed their 2020 or 2019 tax return, or those who used the IRS Non-Filers tool, are eligible for the payment.

Why Are $1,400 IRS Stimulus Checks Being Sent?

The $1,400 stimulus checks are part of the American Rescue Plan, a comprehensive package designed to mitigate the economic impact of the COVID-19 pandemic. The primary goals of these payments are:

Economic Stimulus: To inject money into the economy and boost consumer spending, thereby supporting businesses and job creation.

Financial Relief: To provide direct financial assistance to individuals and families struggling with the economic consequences of the pandemic, such as job loss, reduced hours, or medical expenses.

Support for Vulnerable Populations: To help vulnerable populations, including low-income households, seniors, and those with limited access to healthcare and other essential services.

How to Receive Your $1,400 IRS Stimulus Check

If you're eligible for the $1,400 stimulus check, you don't need to take any action to receive it. The IRS will automatically send the payment to your bank account or mail a check to your address on file. You can:

Check Your Eligibility: Use the IRS Get My Payment tool to check your eligibility and payment status.

Update Your Bank Account Information: If you've changed banks or want to receive your payment via direct deposit, update your information on the IRS website.

Wait for Your Payment: Stimulus checks are being sent in batches, so it may take a few weeks to receive your payment.

In conclusion, the $1,400 IRS stimulus checks are a vital component of the American Rescue Plan, providing much-needed financial relief to individuals and families affected by the COVID-19 pandemic. By understanding the eligibility criteria and purpose of these payments, you can determine if you qualify and take steps to receive your stimulus check. Remember to check your eligibility and payment status using the IRS Get My Payment tool, and update your bank account information if necessary.