Understanding IFTA 1st Quarter Fuel Tax Rates 2025: A Guide by the Department of Revenue

Table of Contents

- Ifta Fuel Tax Rates 4th Quarter 2024 - Danya Ellette

- IFTA, Inc. International Fuel Tax Association

- A Quick Guide to IFTA Fuel Taxes

- Understanding IFTA and Fuel Taxes | Episode 29 | Haulin Assets

- Fillable Online Form IFTA-105. IFTA 105 4th quarter table 1 Fax Email ...

- Understanding IFTA Fuel Tax - Trucking Blogs - ExpeditersOnline.com

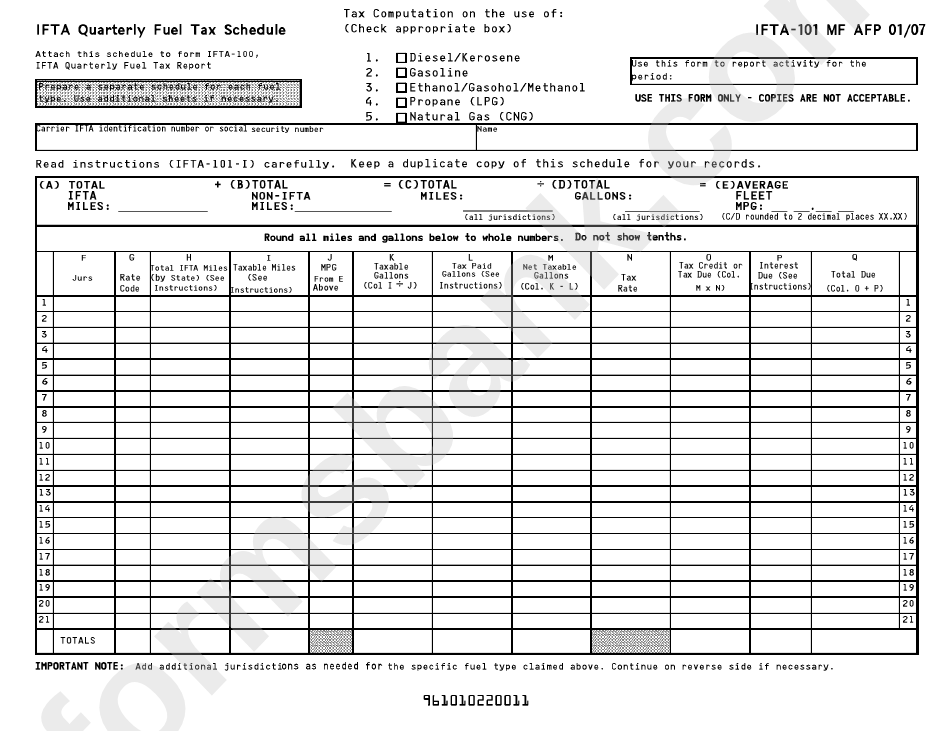

- Form Ifta-101 - Ifta Quarterly Fuel Tax Schedule - 2007 printable pdf ...

- Fillable Online tax ny IFTA, Inc. International Fuel Tax ...

- PPT - 3rd quarter - ifta tax rate changes PowerPoint Presentation, free ...

- 2025 Tax Forms 2025 Sr Schedule 1 - Martin Riggs

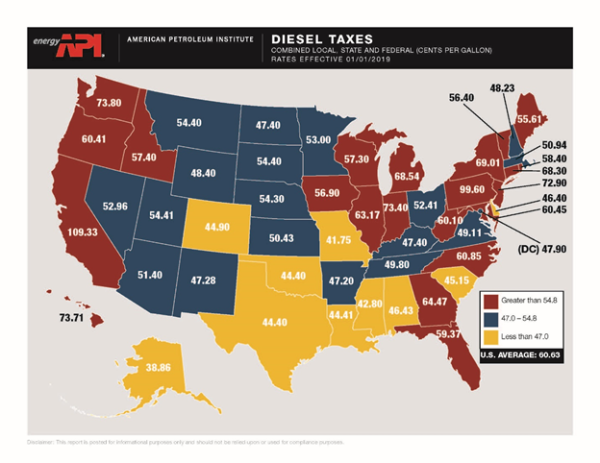

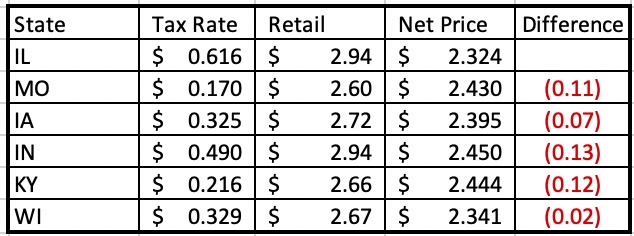

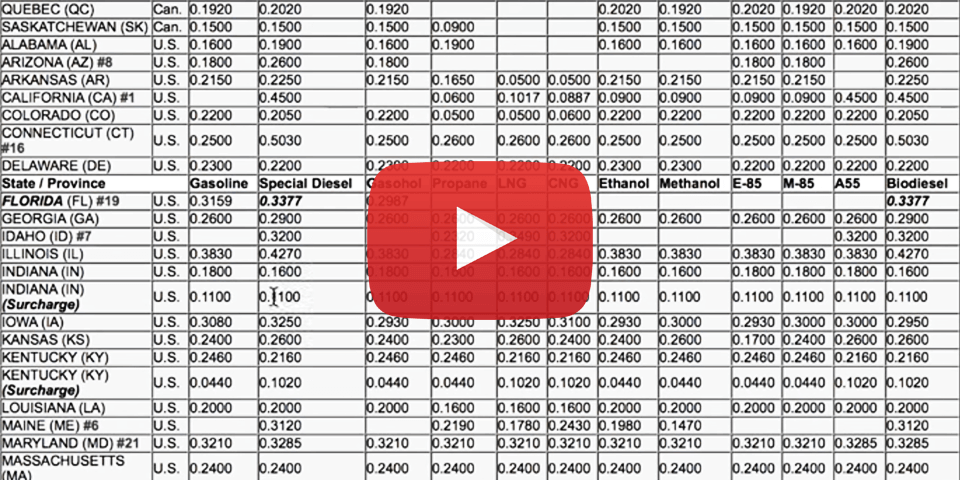

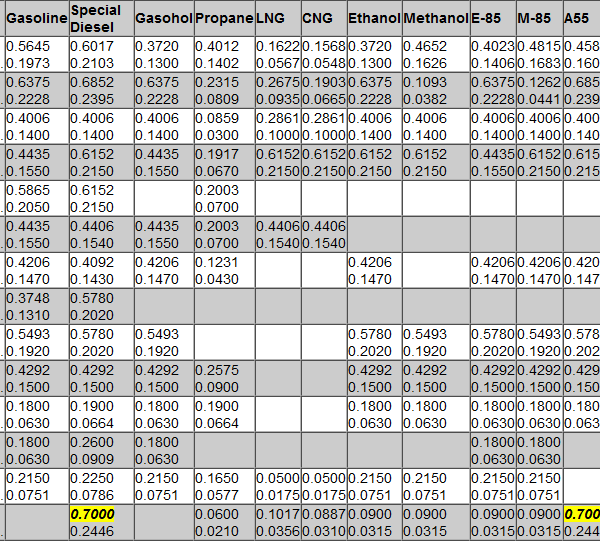

The IFTA fuel tax rates are subject to change quarterly, and it's crucial to understand these changes to ensure compliance and avoid any penalties. The Department of Revenue is responsible for calculating and publishing these rates, which are used to determine the amount of fuel tax owed by carriers. The rates are based on the average fuel prices in each jurisdiction and are adjusted quarterly to reflect changes in the fuel market.

Key Highlights of IFTA 1st Quarter Fuel Tax Rates 2025

It's essential to note that these rates are subject to change, and carriers should check the Department of Revenue website for the most up-to-date information. Additionally, carriers can use online tools and software to help calculate their fuel tax liability and ensure compliance with IFTA regulations.

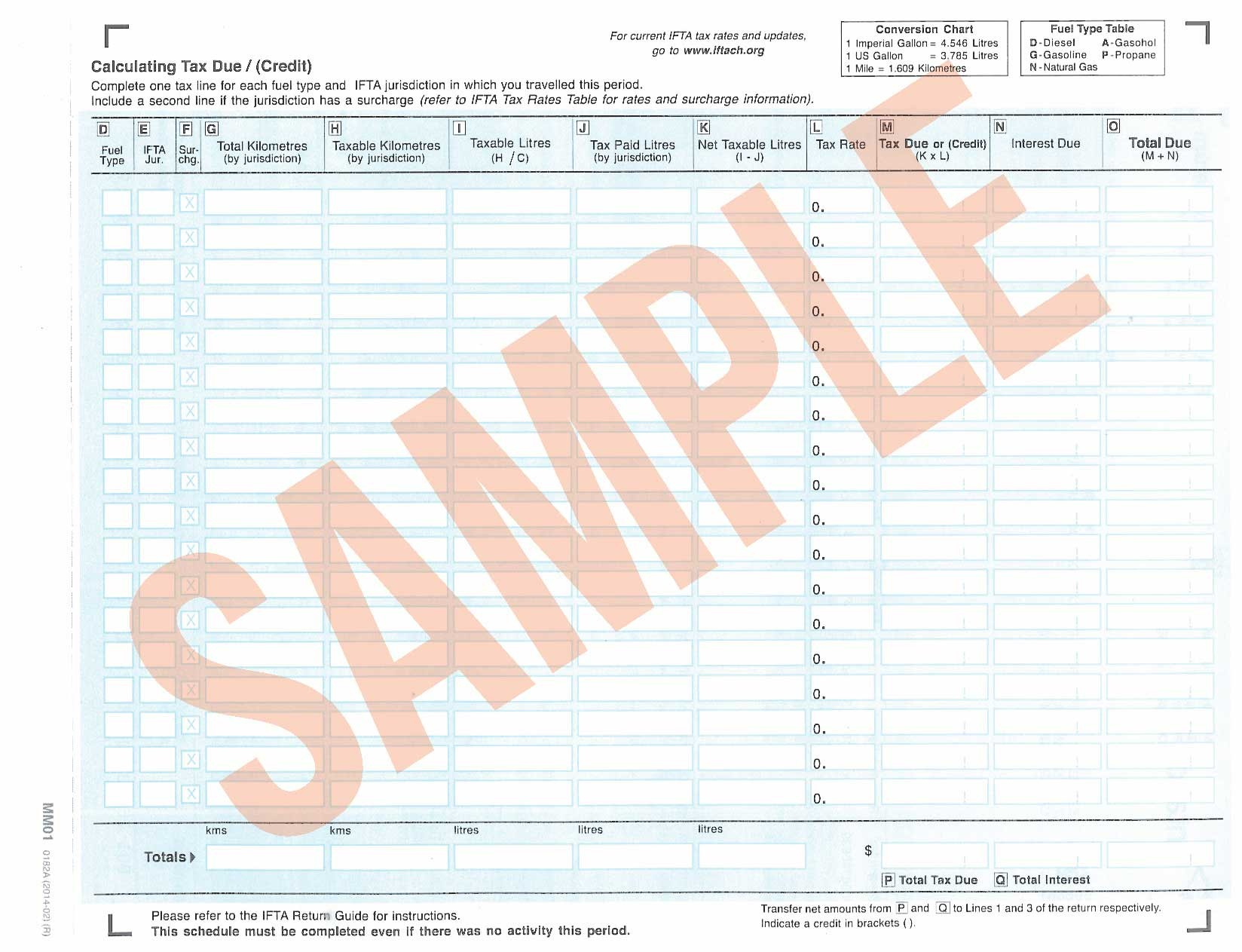

How to Calculate IFTA Fuel Tax Liability

Carriers can use online tools and software to simplify the calculation process and ensure accuracy. It's also recommended to consult with a tax professional or accountant to ensure compliance with all IFTA regulations.

In conclusion, understanding the IFTA 1st Quarter Fuel Tax Rates 2025 is crucial for carriers to ensure compliance with regulations and avoid any penalties. The Department of Revenue provides the necessary information and resources to help carriers calculate their fuel tax liability and file their IFTA returns. By staying up-to-date on the latest fuel tax rates and using online tools and software, carriers can simplify the process and focus on their core business.For more information on IFTA fuel tax rates and regulations, visit the Department of Revenue website or consult with a tax professional. Stay ahead of the game and ensure compliance with IFTA regulations to avoid any penalties and interest.

Note: The information provided in this article is subject to change and may not reflect the current fuel tax rates. Carriers should always check the Department of Revenue website for the most up-to-date information.