Pfizer Inc. (PFE) is one of the world's largest pharmaceutical companies, with a diverse portfolio of prescription medications, vaccines, and consumer healthcare products. As a leading player in the healthcare industry, Pfizer's stock performance is closely watched by investors and analysts alike. In this article, we will provide an overview of Pfizer's stock price, its historical trends, and the factors that influence its market value.

Current PFE Stock Price and Quote

As of the latest market update, the PFE stock price is trading at around $43.50 per share, with a market capitalization of over $240 billion. The stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol PFE. You can check the current

PFE stock quote on MarketWatch for the latest updates.

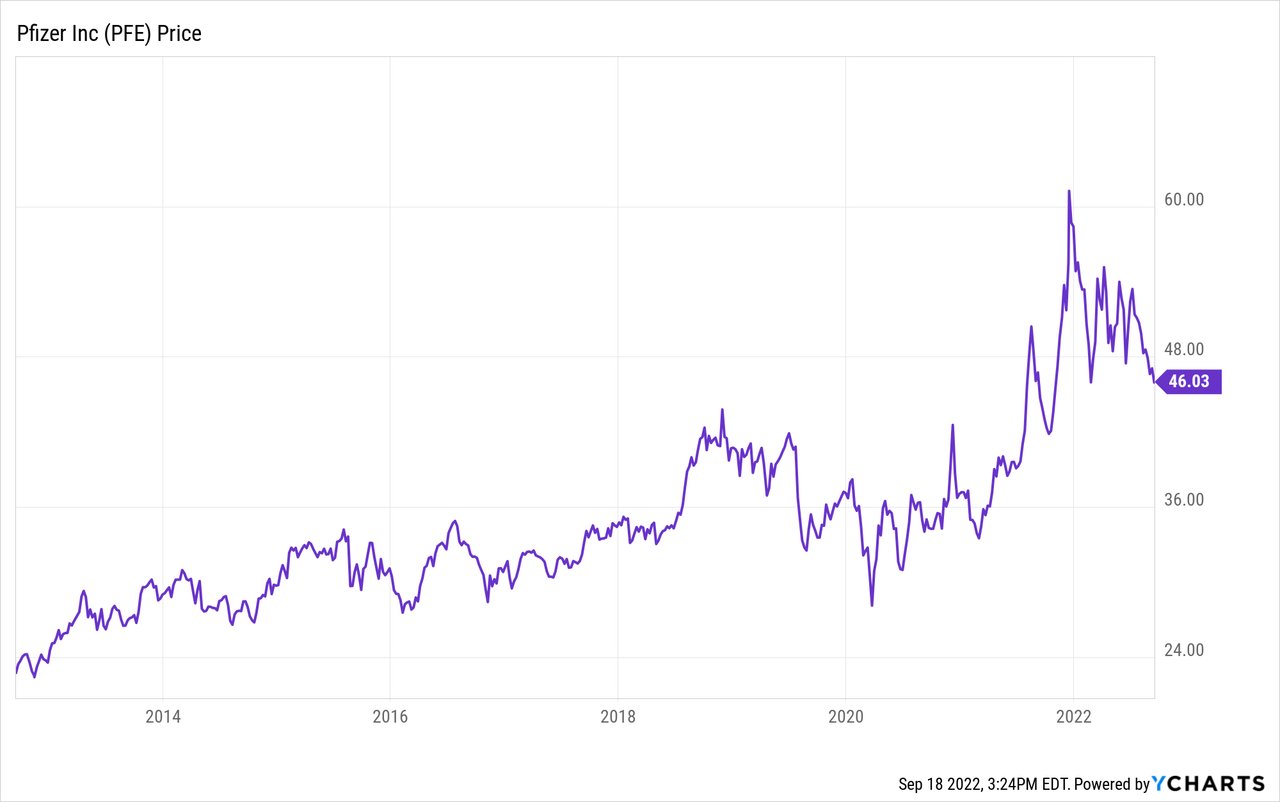

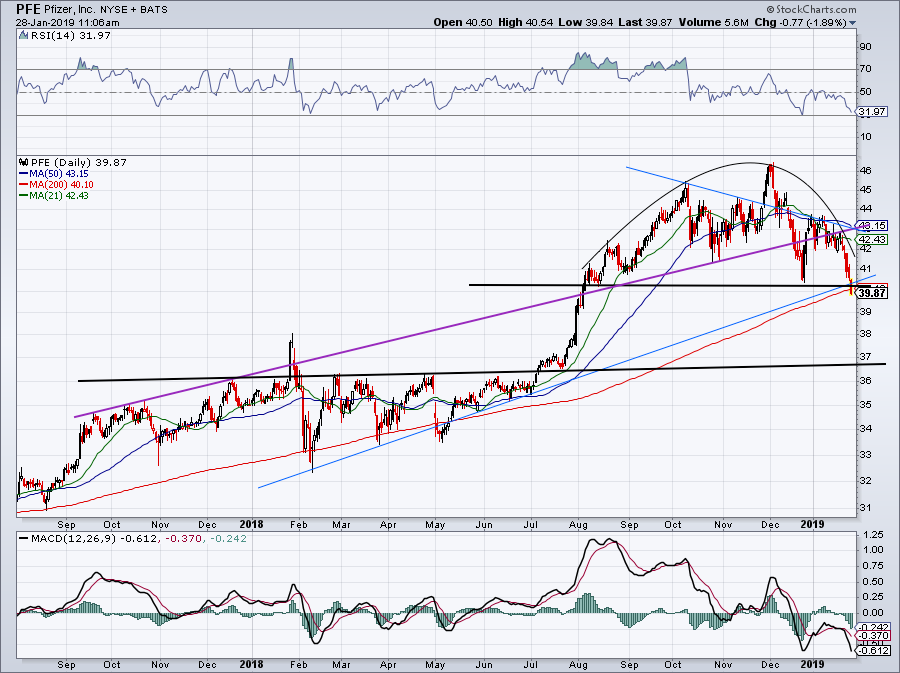

Historical Stock Performance

Pfizer's stock price has experienced significant fluctuations over the years, reflecting the company's financial performance, industry trends, and global economic conditions. In the past 12 months, PFE stock has traded in a range of $33.50 to $46.50 per share, with a 52-week high of $46.50 and a 52-week low of $33.50.

Factors Influencing PFE Stock Price

Several factors contribute to the fluctuations in Pfizer's stock price, including:

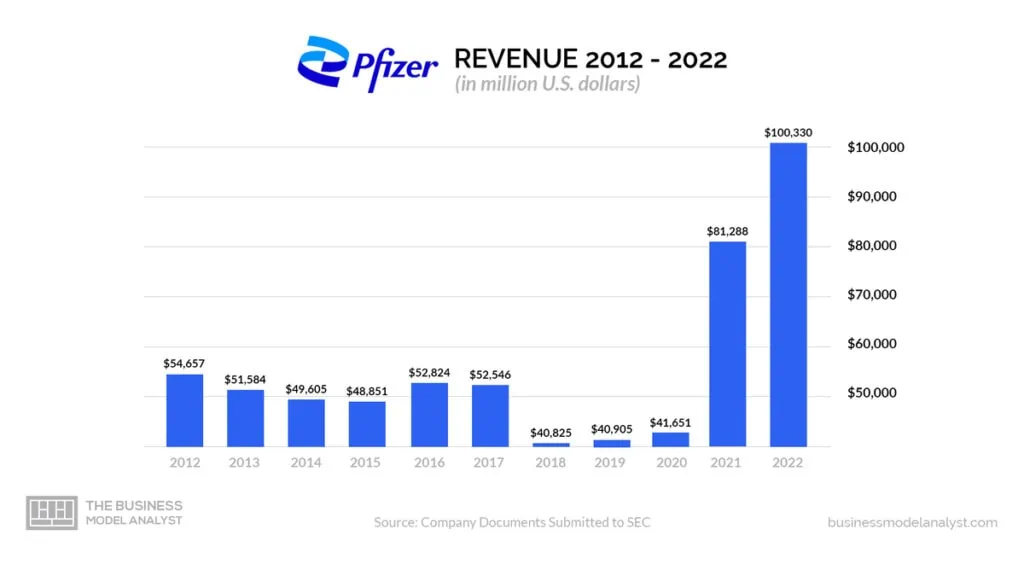

Financial Performance: Pfizer's revenue and earnings growth, as well as its dividend yield, are key drivers of its stock price.

Product Pipeline: The success of Pfizer's new product launches, such as its COVID-19 vaccine, and the potential of its pipeline products can significantly impact the stock price.

Industry Trends: Changes in the healthcare landscape, including regulatory developments and competitor activity, can influence Pfizer's stock performance.

Global Economic Conditions: Economic downturns, trade wars, and interest rate changes can affect Pfizer's stock price, as well as the broader market.

Investment Prospects

Pfizer's stock offers a relatively stable investment opportunity, with a dividend yield of around 4.5% and a strong track record of dividend payments. The company's diversified portfolio and significant research and development investments position it for long-term growth. However, investors should carefully consider the potential risks and challenges facing the company, including increased competition, regulatory pressures, and global economic uncertainty.

Pfizer's stock price is a closely watched indicator of the company's financial health and industry trends. With its strong brand, diverse product portfolio, and commitment to innovation, Pfizer remains a leading player in the healthcare sector. As with any investment, it's essential to conduct thorough research and consider multiple factors before making a decision. For the latest

PFE stock quote and news, visit MarketWatch.

Note: This article is for informational purposes only and should not be considered as investment advice.